For HR Analytics implementations sourced from Peoplesoft, the Payment Type dimension table (W_PAY_TYPE_D) is loaded from eight separate SDE (Source Dependent Extract) mappings. Each mapping extracts a different Payment Type category. The eight mappings are:

- SDE_PSFT_PayTypeDimension_Deductions

- SDE_PSFT_PayTypeDimension_Earnings

- SDE_PSFT_PayTypeDimension_FederalTaxes

- SDE_PSFT_PayTypeDimension_LocalTaxes1

- SDE_PSFT_PayTypeDimension_LocalTaxes2

- SDE_PSFT_PayTypeDimension_StateTaxes1

- SDE_PSFT_PayTypeDimension_StateTaxes2

- SDE_PSFT_PayTypeDimension_Total

Each of those SDE mappings inserts rows in the Payment Type Dimension staging table (W_PAY_TYPE_DS) which is then loaded into the W_PAY_TYPE_D table thru the SIL (Source Independent Load) mapping SIL_PayTypeDimension.

Each of the SDE mappings has a similar structure and flow:

The only difference between the mappings is the inital BC (Business Component) mapplet that references the specific Peoplesoft tables required to populate a particular payment type category.

An example of the mapplet flow for one of the local taxes mappings:

For each mapplet, we will now examine the source Peoplesoft tables and the SQL used to extract the rows for a particular Payment Type.

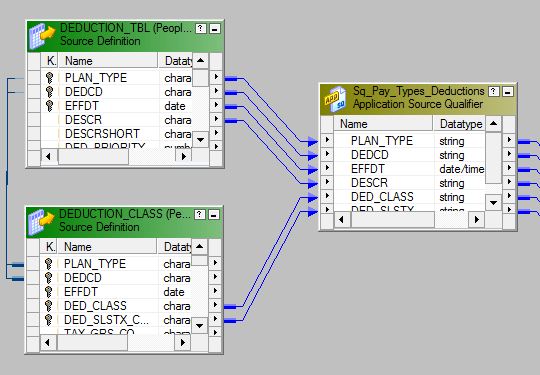

Mapplet: mplt_BC_PSFT_PayTypeDimension_Deductions

SQL:

SELECT PS_DEDUCTION_TBL.PLAN_TYPE,

PS_DEDUCTION_TBL.DEDCD,

PS_DEDUCTION_TBL.EFFDT,

PS_DEDUCTION_TBL.DESCR,

PS_DEDUCTION_CLASS.DED_CLASS,

PS_DEDUCTION_CLASS.DED_SLSTX_CLASS

FROM PS_DEDUCTION_TBL, PS_DEDUCTION_CLASS

WHERE

{

PS_DEDUCTION_TBL LEFT OUTER JOIN PS_DEDUCTION_CLASS ON

PS_DEDUCTION_CLASS.DEDCD = PS_DEDUCTION_TBL.DEDCD

AND PS_DEDUCTION_CLASS.PLAN_TYPE = PS_DEDUCTION_TBL.PLAN_TYPE

AND PS_DEDUCTION_TBL.EFFDT = PS_DEDUCTION_CLASS.EFFDT

}

Mapplet: mplt_BC_PSFT_PayTypeDimension_Earnings

SQL: SELECT * FROM PS_EARNINGS_TBL (no filters applied)

Mapplet: mplt_BC_PSFT_PayTypeDimension_FederalTaxes

SQL:

SELECT PS_STATE_TAX_TBL.STATE

,PS_STATE_TAX_TBL.EFFDT

,PS_STATE_TAX_TBL.EFF_STATUS

FROM

PS_STATE_TAX_TBL

WHERE STATE IN ('$E' ,'$U')

Mapplet: mplt_BC_PSFT_PayTypeDimension_LocalTaxes1

SQL: SELECT * FROM PS_LOCAL_TAX_TBL (no filters applied)

Mapplet: mplt_BC_PSFT_PayTypeDimension_LocalTaxes2

SQL:

SELECT PS_STATE_TAX_TBL.STATE,

PS_STATE_TAX_TBL.EFFDT,

PS_STATE_TAX_TBL.EFF_STATUS

FROM PS_STATE_TAX_TBL

WHERE STATE LIKE 'Z%'

Mapplet: mplt_BC_PSFT_PayTypeDimension_StateTaxes1

SQL:

SELECT PS_STATE_TAX_TBL.STATE,

PS_STATE_TAX_TBL.EFFDT,

PS_STATE_TAX_TBL.EFF_STATUS

FROM PS_STATE_TAX_TBL

WHERE STATE NOT IN ('$E', '$U') AND STATE NOT LIKE 'Z%'

Mapplet: mplt_BC_PSFT_PayTypeDimension_StateTaxes2

SQL:

SELECT PS_ST_OTH_TAX_TBL.STATE,

PS_ST_OTH_TAX_TBL.EFFDT,

PS_ST_OTH_TAX_TBL.TAX_CLASS

FROM PS_ST_OTH_TAX_TBL

WHERE STATE NOT IN ('$E', '$U') AND STATE NOT LIKE 'Z%'

Mapplet: mplt_BC_PSFT_PayTypeDimension_Total

NOTE: This mapplet generates the four standard total level payment

types which are used on cumulative fact rows.

SQL:

SELECT DISTINCT 'TOTAL_DEDUCTIONS' TOTAL_KEY FROM PS_EARNINGS_TBL

UNION

SELECT DISTINCT 'TOTAL_TAXES' TOTAL_KEY FROM PS_EARNINGS_TBL

UNION

SELECT DISTINCT 'TOTAL_GROSS' TOTAL_KEY FROM PS_EARNINGS_TBL

UNION

SELECT DISTINCT 'NET_PAY' TOTAL_KEY FROM PS_EARNINGS_TBL

No comments:

Post a Comment